Stamp Duty Calculation Malaysia 2019

The assessment and collection of stamp duties is sanctioned by statutory law now described as the stamp act 1949 types of duty.

Stamp duty calculation malaysia 2019. Calculate stamp duty sdlt in england and northern ireland with our instant stamp duty calculator. For certain people buying a house is a major milestone that tops many people s lifetime to do lists. The ultimate guide to understanding stamp duty calculation malaysia 2019 and to get stamp duty malaysia exemption for the first time in your life stamp duty exemption is when you are exempted from paying stamp duty for buying a house or transfer a property to another person.

Select single property or additional property. You will also need to pay the stamp duty on your loan agreement based on a flat rate of 0 5 of the total loan. Rm2250 rm1500 rm750 stamp duty to pay saving amount.

Purchasing and hunting for a house can be exciting and stressful experience. An instrument is defined as any written document and in general stamp duty is levied on legal commercial and financial instruments. Rm100 001 to rm500 000 stamp duty fee 3.

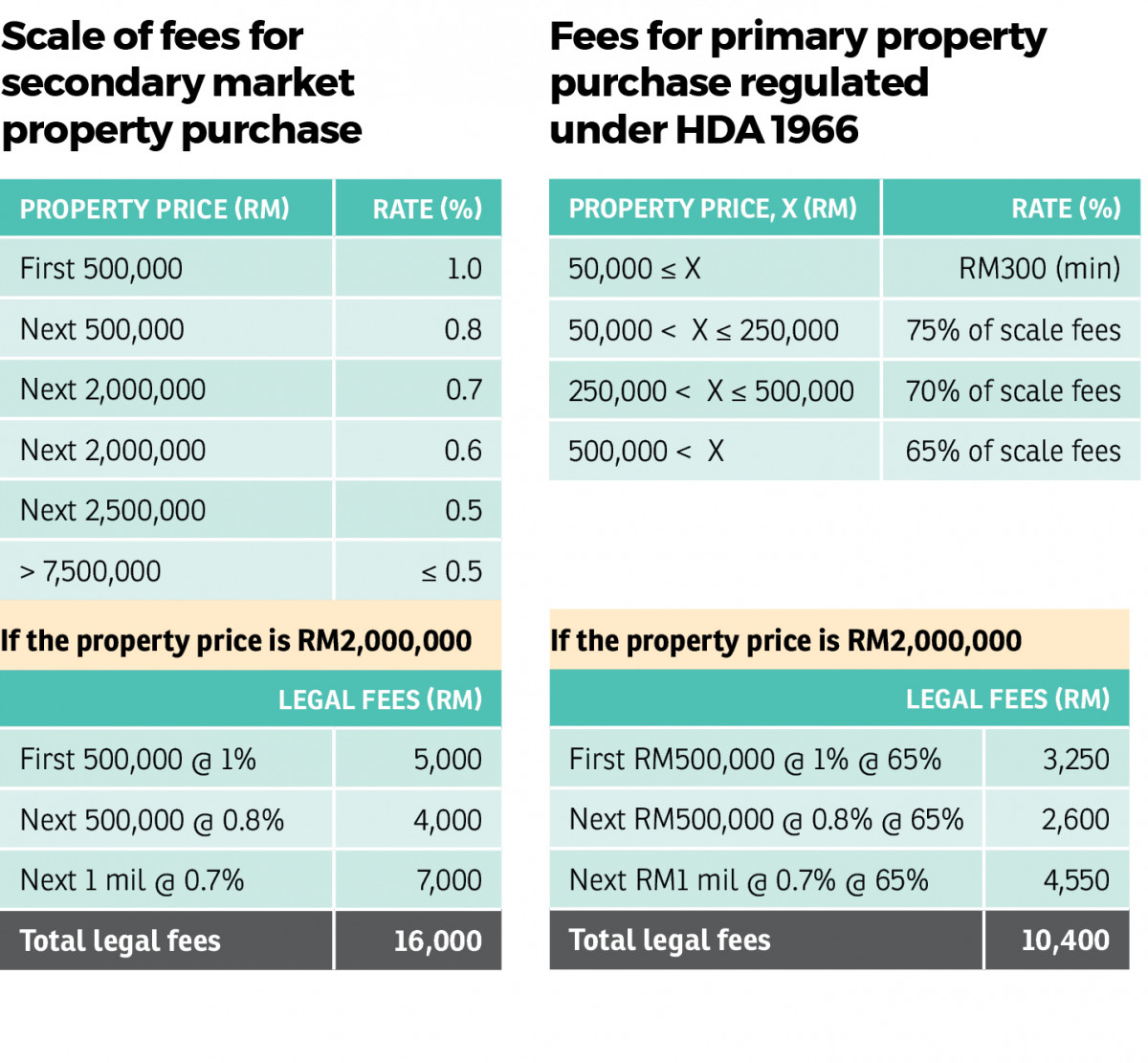

Please contact us for a quotation for services required. 2019 stamp duty scale from 1st january 2019 30th june 2019 stamp duty fee 1. In 2019 the government announced a stamp duty hike for properties costing more than rm1 million where the rate was increased from 3 to 4 refer to the table below.

At the prevailing rate of stamp duty. The actual calculation of stamp duty is before first time house buyer stamp duty exemption rm450 000 x 0 50 rm2250 00 after first time house buyer stamp duty exemption. The rate of duty varies.

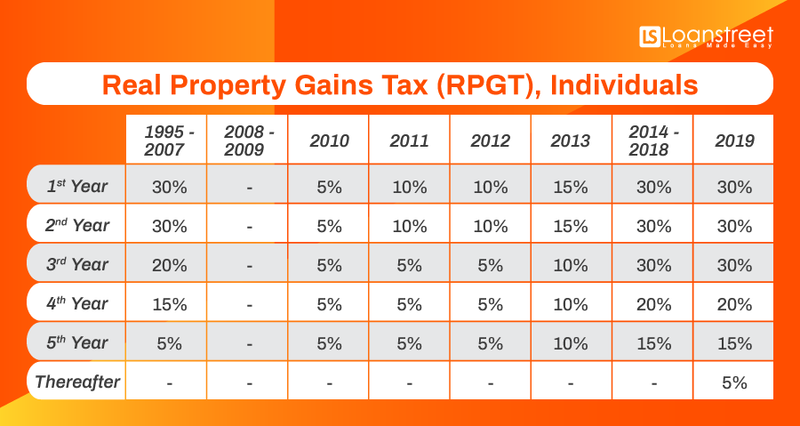

How will the recent changes in rpgt and stamp duty begin to affect you. Calculate how much stamp duty you will pay. To know how much down payment lawyer fees and stamp duty needed are so.

Learn about malaysia s property stamp duty and real property gains tax rpgt in 2019. Home malaysia law firm malaysia law statutes legal fee stamp duty for sale purchase agreement loan the calculation formula for legal fee stamp duty is fixed as they are governed by law. Legal fees stamp duty calculation 2020 when buying a house in malaysia.

Note 1 purchase of first residential home by a malaysian citizen note 2 purchase of first residential home by a malaysian citizen from a property developer. Maximize your returns and minimize costs risks when selling property in malaysia. For the purpose of first home ownership under the rent to own rto scheme managed by the national housing department nhd full stamp duty exemption is given on the instrument.

Rpgt rpgt calculation chargeable gain disposal price. Rm1500 00 grand total stamp duty saving for first time house buyer is rm6500 00. Hence the latest stamp duty rates on the spa mot are calculated on a tiered basis as below.

For first rm100 000 stamp duty fee 2. Rm100 001 to rm500 000 stamp duty fee 3. The calculators have been updated following the introduction of a stamp duty holiday until 31st march 2021.