Tax Installment Payments Malaysia

With effect from y a 2008 where a sme first commences operations in a year of assessment the sme is not required to furnish an estimate of tax payable or make instalment payments for a period of two years beginning from the year of assessment in which the sme.

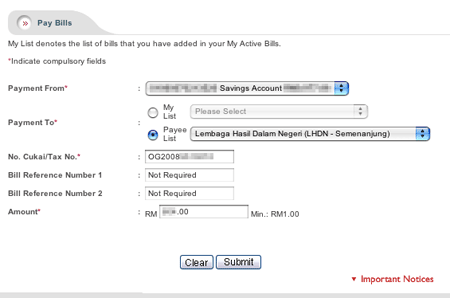

Tax installment payments malaysia. Bayaran cukai pendapatan menggunakan kad kredit boleh dilakukan di portal byrhasil dari jam 12 00 am hingga 10 59 pm setiap hari. Malaysia corporate tax administration last reviewed 01 july 2020. It s the only online platform that supports payment by credit cards visa mastercard and american express so you can earn some points or cashback for paying income tax just note that there is a processing fee of 0 8 imposed for credit card payments.

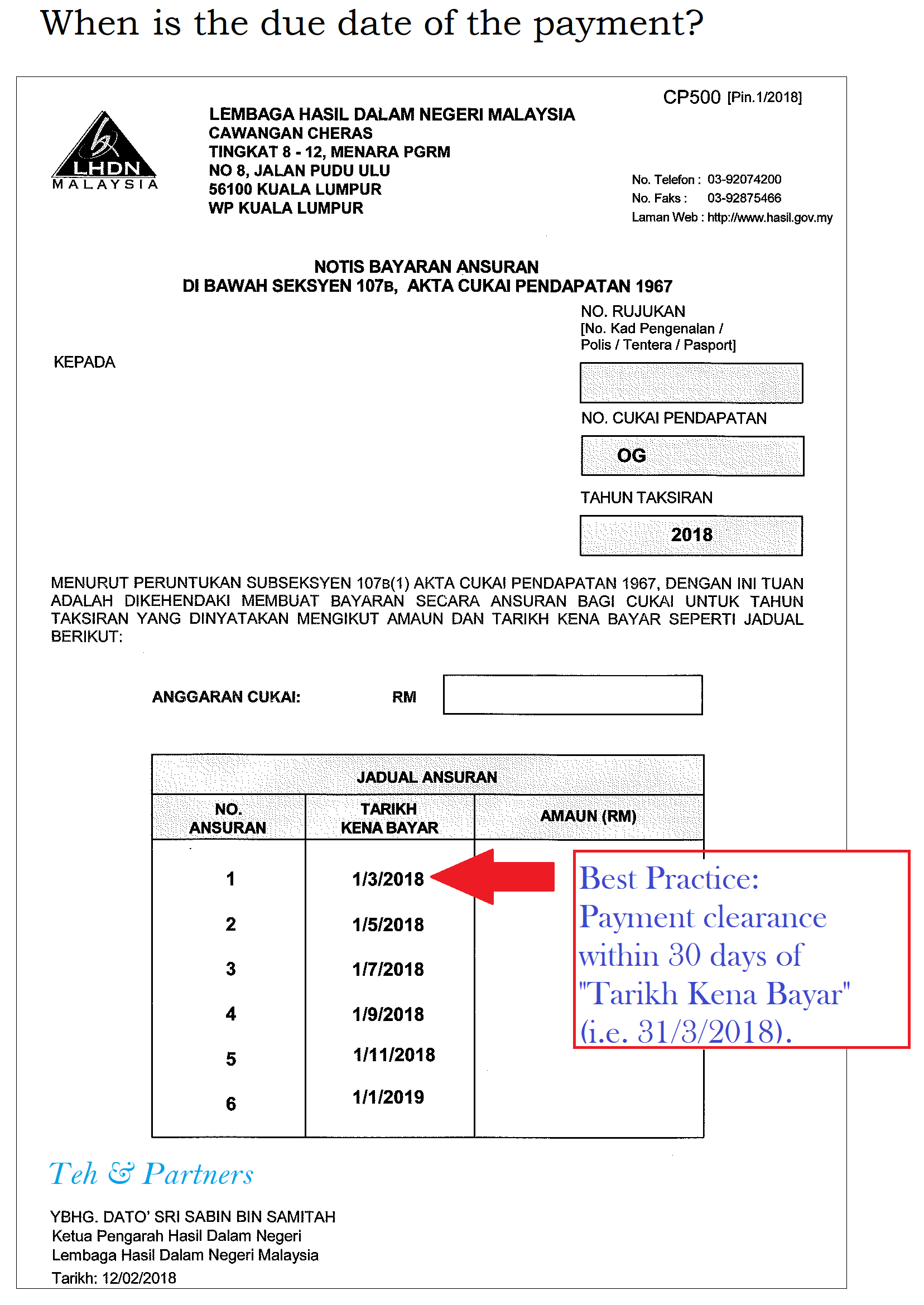

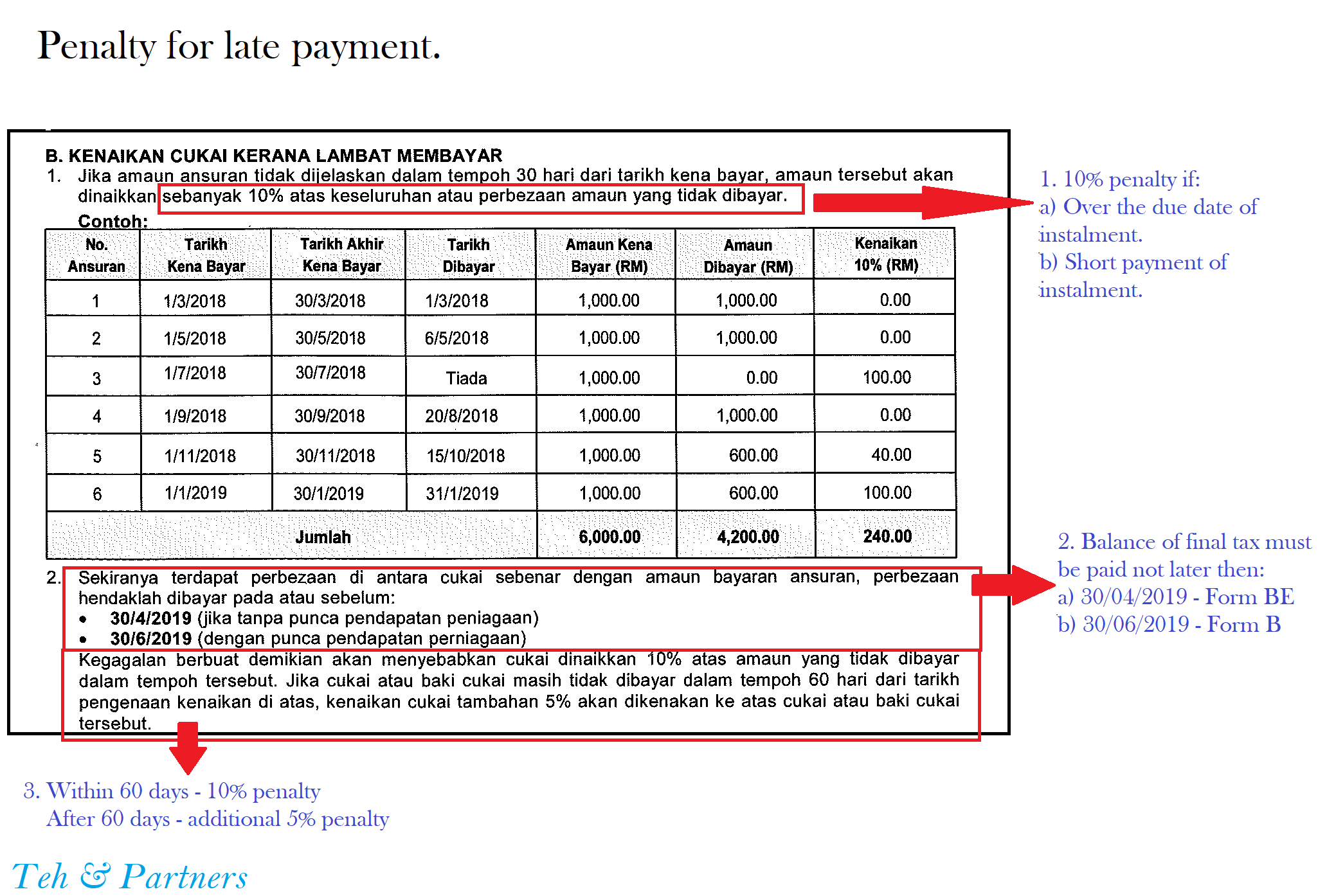

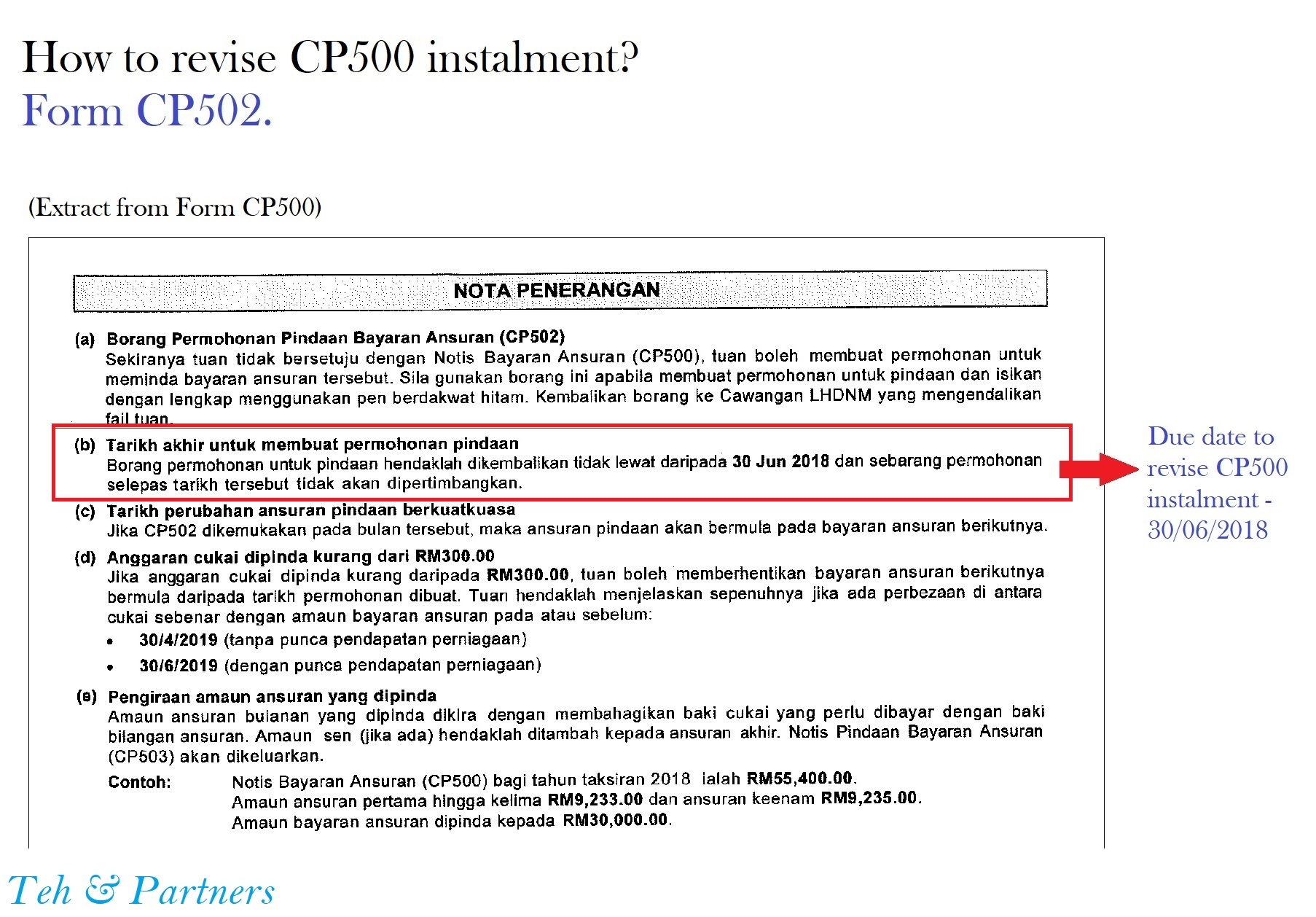

You can pay your income tax with your credit card through fpx participating bank at https byrhasil hasil gov my all visa mastercard and american express credit cards issued in malaysia can be used for this service. A company is taxed on income from all sources whether business or non business arising in its financial year ending in the calendar year that coincides with that particular year of assessment. The monthly tax installment payments to accompany form cp500 for march 2020 and for may 2020 can be deferred without the imposition of penalties.

Please use the cp 207 payment slip as a guide to fill up irbm s bank in slip provided at the bank to make payment. The irbm will not issue any other receipt for payments made through the bank. You ll still need to pay taxes for income earned in malaysia and will be taxed at a different rate from residents.

Perkhidmatan ini boleh digunakan untuk semua kad kredit visa mastercard dan american express yang dikeluarkan di malaysia. 03 8911 1000 call within malaysia or 603 8911 1100 call from oversea. 3 pay income tax via lhdn agents.

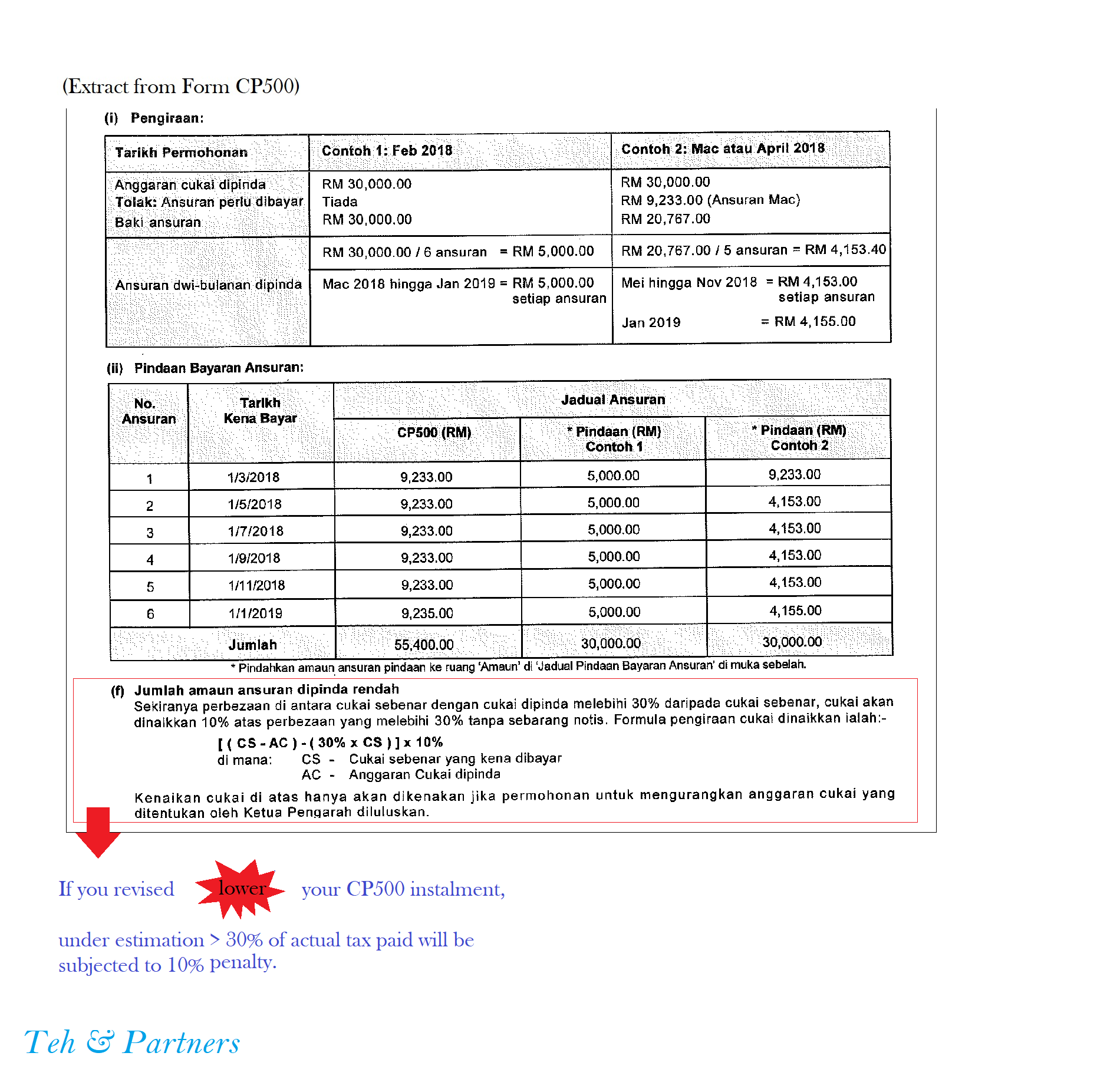

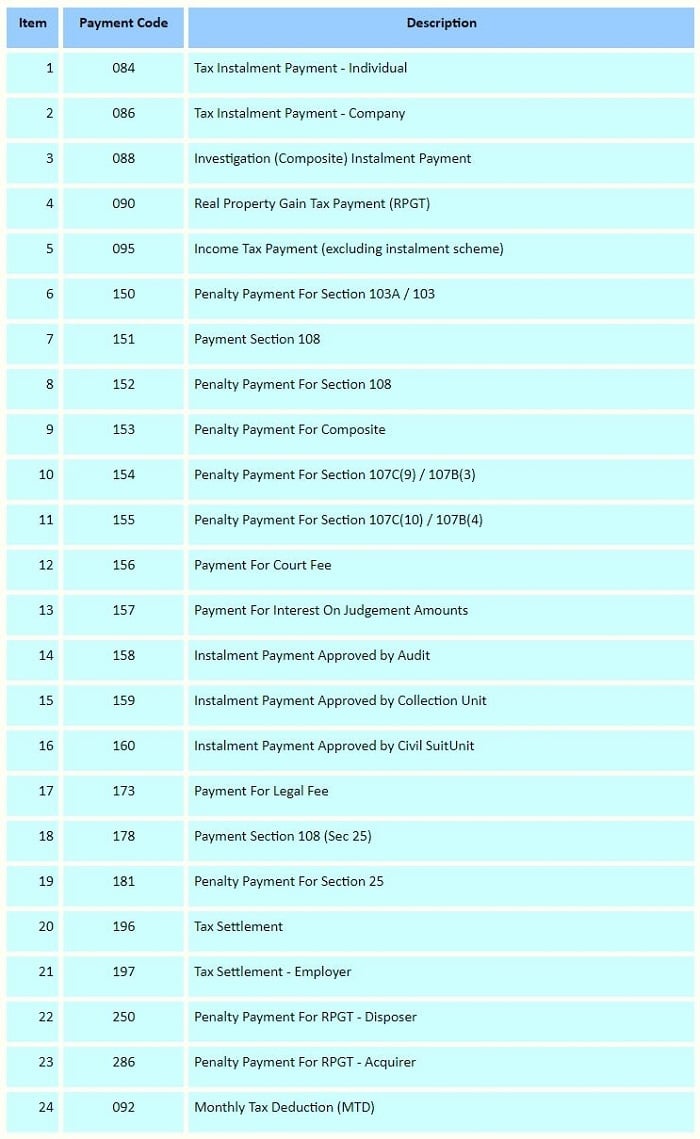

Taxpayer will have to call the stated number to get the payment procedure for tax payment via telegraphic transfer. Melayu malay 简体中文 chinese simplified estimate of tax payable in malaysia. Perkhidmatan akan ditutup dari jam 11 00 pm hingga 11 59 pm setiap hari bagi tujuan penyenggaraan sistem.

Sebarang pertanyaan sila hubungi. Further to the release of economic stimulus package on 27 february 2020 the malaysian inland revenue board has issued the prescribed application forms in respect of the following. Assessment of income is on a current year basis.

Read an april 2020 report prepared by the kpmg member firm in malaysia. Therefore whether you are a malaysian or a foreign national as long as you reside in malaysia for less than 182 years in a year any income you earn in malaysia is taxable under non resident income tax rates. The customer s copy of the bank in slip must be kept as a proof of payment.

Hasil care line. Tax payment can also be made at any cimb bank public bank maybank affin bank bank rakyat bank simpanan nasional and pos malaysia counters throughout malaysia. Deferment of tax instalment payments for 6 months from 1 april 2020 to 30 september 2020 for tourism industry such as travel agencies hoteliers and airlines.

The best would be via the irb s own online platform byrhasil. Here are the income tax rates for non residents in malaysia. This page is also available in.