Types Of Tax Professional In Malaysia

Malaysia sales tax service tax service tax and sales tax are currently the two major types of consumption taxes imposed on certain prescribed goods and services.

Types of tax professional in malaysia. Some of the major. The tax is paid directly to the government. There are two different kinds of taxes in malaysia which are a direct and indirect tax.

Sales tax is be imposed at the rate of 0 5 10 or a specific rate for petroleum products and the service tax is at the rate of 6. Having said that there are exemptions for resident banks. Resident organisations carrying out business of air sea transport banking and insurance are taxable on their global income.

The malaysian taxation system is an essential core subject in accounting and business in malaysia. Examples of direct tax are income tax and real property gains tax. The statutory body who is in charged with the direct tax is the malaysia inland revenue board lhdn.

The sales and services tax sst implemented on 1 september 2018 has added to the depth and complexity of the malaysia tax system. There are different types of tax in malaysia. A direct tax is a tax that is levied on a person or company s income and wealth.

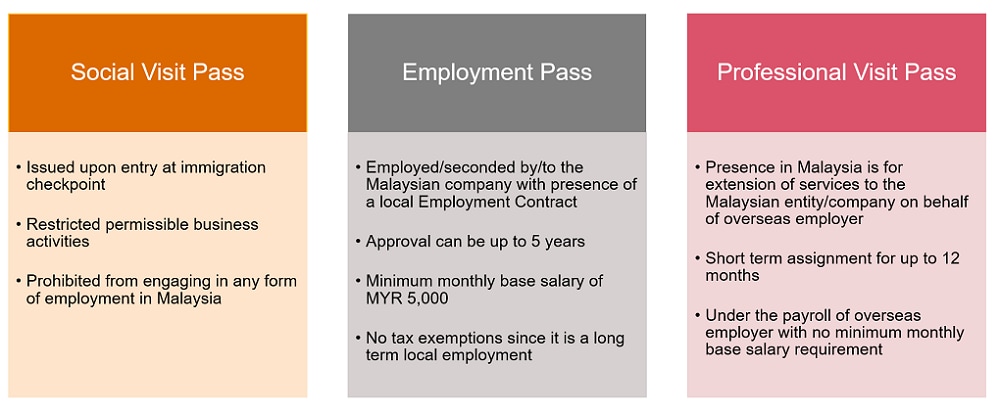

In malaysia corporations are subject to corporate income tax real property gains tax goods and services tax gst and etc taxes. These also apply to foreigners. In other words resident and non resident organisations doing business and generating taxable income in malaysia will be taxed on income accrued in or derived from malaysia.

The tax year in malaysia runs in accordance with the calendar year beginning. The sst replaces the old goods and services tax gst in malaysia which was implemented in 2015. The malaysian taxation system involves both legal principles and computational elements.