What Is Disposal Of Asset Under The Real Property Gains Tax Act 1976

This tax is provided for in the real property gains tax act 1976 act 169.

What is disposal of asset under the real property gains tax act 1976. 7 november 1975 be it enacted by the seri paduka baginda yang di pertuan. What most people don t know is that rpgt is also applicable in the procurement and disposal of shares in companies where 75 of their tangible assets are in properties a k a. Under the real property gains tax act 1976 rpgt act an rpc is a controlled company which the defined value of its real property or shares in another rpc or both is at least 75 of the value of its tangible assets.

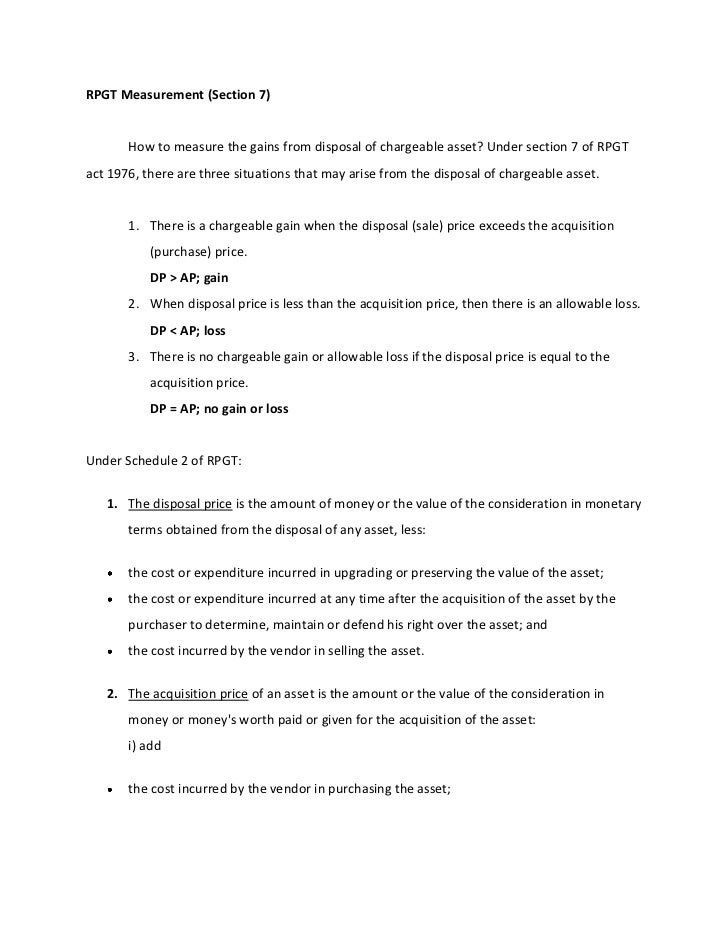

3 order 2018 p u. This is clearly spelt out under the real property gains tax rpgta 1976 which only imposes tax on chargeable gain accruing on the disposal of any real property not assessed to income tax. A chargeable gain is a profit when the disposal price is more than the purchase price of the property.

Disposal is generally triggered upon transfer of ownership from one person to another whether by way of sale conveyance assignment settlement alienation etc. Real property gains tax exemption order 2011 5 2 2 where the disposal of a chargeable asset is made in the sixth year after the date of acquisition of such chargeable asset or any year thereafter the minister exempts any person from the application of schedule 5 of the act on the payment of tax on the. The disposer and the acquirer are exempted from completing and submitting the relevant disposal and acquisition forms if the disposal of the assets subject to the income tax act 1967.

Rpc is essentially a controlled company where its total tangible assets consists of 75 or more in real property and or shares in another rpc. Although capital gains are generally not taxed in malaysia one exception to this is the gains arising from the disposal of either real property or shares in a real property company rpc. Real property gains tax rpgt is a tax levied by the inland revenue board irb on chargeable gains derived from the disposal of real property.

A controlled company is essentially a company owned by not more than 50 members and controlled by not more than 5 persons. Real property companies rpc. Based on the real property gains tax act 1976 rpgt is a tax on chargeable gains derived from the disposal of property.

Rpgt applies to both residents and non residents. Real property gains tax act 1976 an act to provide for the imposition assessment and collection of a tax on gains derived from the disposal of real property and matters incidental thereto. Real property gains tax 7 laws of malaysia act 169 real property gains tax act 1976 an act to provide for the imposition assessment and collection of a tax on gains derived from the disposal of real property and matters incidental thereto.