What Is Gst Malaysia

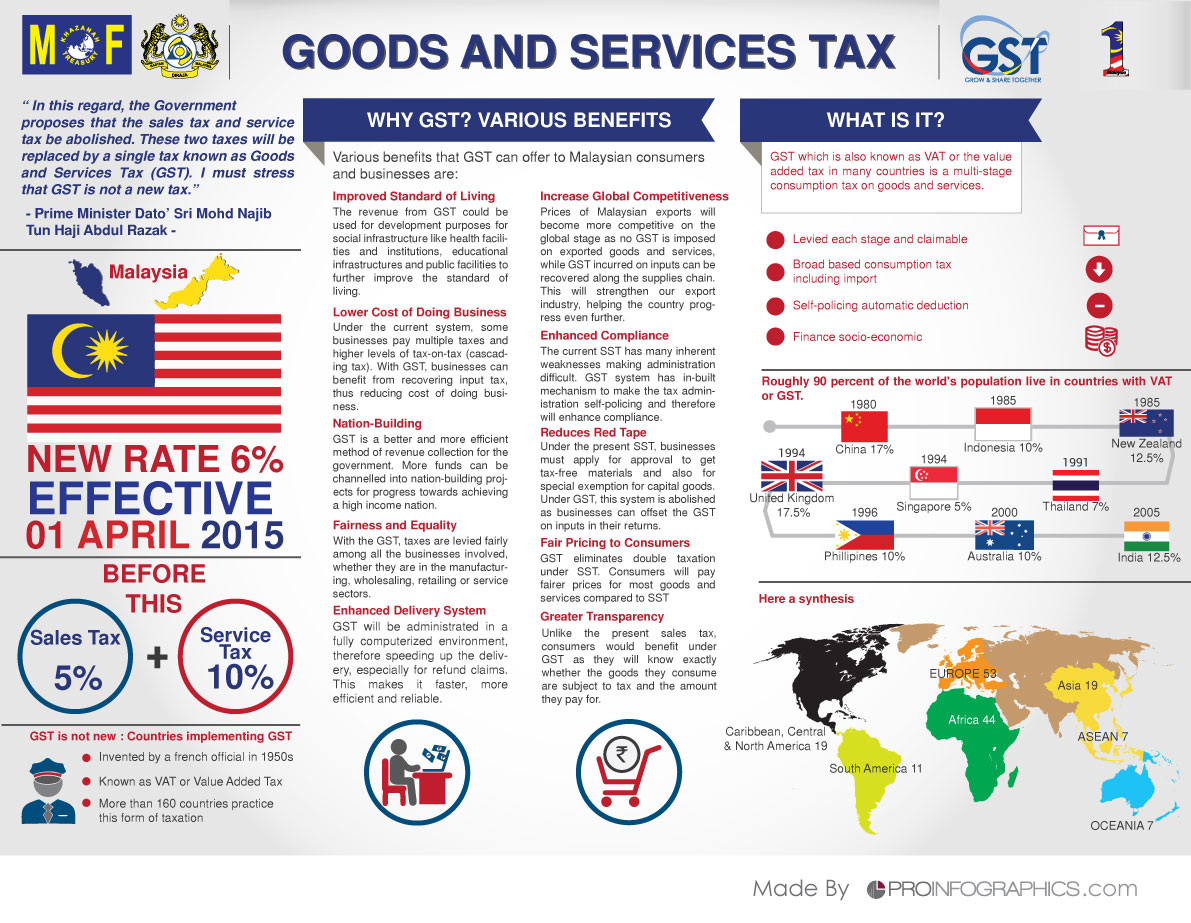

In malaysia the goods and services tax gst was introduced on april 1 2015.

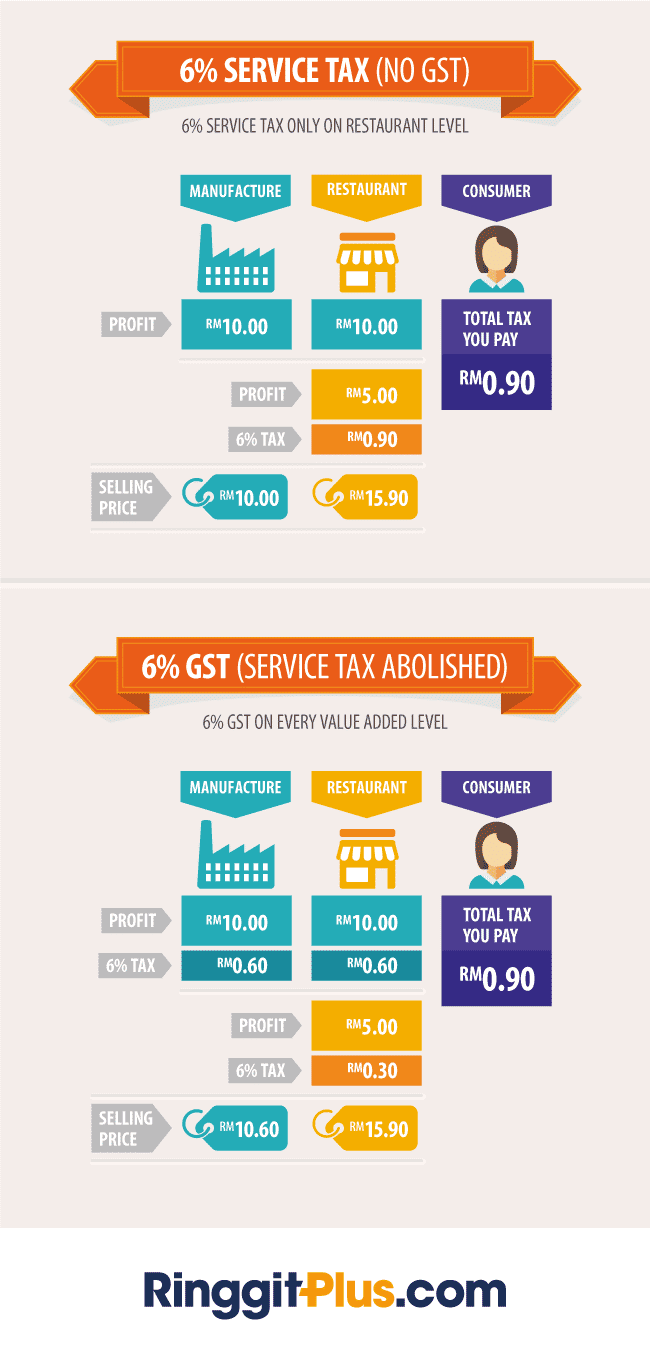

What is gst malaysia. Gst is the consumption tax throughout malaysia levied on almost everything sold in the country. What is gst rate in malaysia. Gst is levied on most transactions in the production process but is refunded with exception of blocked input tax to all parties in the chain of production other than the final consumer.

However with the rollout of the tax seeing delays and numerous clarifications questions remain over what gst is and how it. To modernise its taxation system and improve business efficiency malaysia replaced its sales and service tax regimes with the goods and services tax gst effective 1 april 2015. There are specific rules around digital products which you must follow closely to stay tax compliant.

Exports of goods and the supply of international services are zero rated. Current gst rate in malaysia is 6 for goods and services. Gst exceptions in malaysia.

Malaysia s recent addition of a goods and service tax gst which was passed by the government during the third quarter of 2011 but delayed until april 2016 has been the cause of much confusion within asean s second most developed economy. Gst is a broad based consumption tax covering all sectors of the economy i e all goods and services made in malaysia including imports except specific goods and services which are categorized under zero rated supply and exempt supply orders as determined by the minister of finance and published in the gazette. So if you sell digital products to a customer in malaysia you must charge the gst rate.

Exempt supply means goods and services sold by the companies are free from goods and services tax gst. Gst is a broad based consumption tax covering all sectors of the economy i e all goods and services made in malaysia including imports except specific goods and services which are categorized under zero rated supply and exempt supply orders as determined by the minister of finance and published in the gazette. The malaysian gst system has two rates of gst 6 and 0 and provides for the zero rating of exported goods international services basic food items and many books.

Gst is a broad based consumption tax covering all sectors of the economy i e all goods and services made in malaysia including imports except specific goods and services which are categorized under zero rated supply and exempt supply orders as determined by the minister of finance and published in the gazette. The goods and services tax gst is an abolished value added tax in malaysia. The hope and purpose of gst is to replace the sales and service tax which has been used in the country for several decades.

How to calculate malaysian gst manually. No gst will be charged on these goods services.