What Is Private Retirement Scheme

For most workplace and personal pensions how.

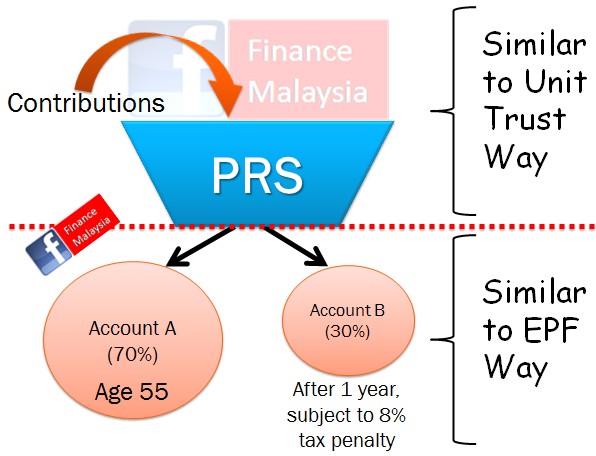

What is private retirement scheme. It aims to grow its. A private retirement scheme prs is a defined contribution private scheme that complements the employees provident fund epf and other retirement plans on a voluntary basis. A private retirement scheme prs is a voluntary long term investment scheme designed to help individuals accumulate savings for retirement.

Prs seek to enhance choices available for all malaysians whether employed or self employed to supplement their retirement savings under a well structured and regulated environment. It complements the mandatory contributions made to epf. What is the private retirement scheme.

What is the private retirement scheme prs. Ppa provides a one stop account management and on going member services to serve and protect your interests. Private retirement schemes prs is a voluntary long term savings and investment scheme designed to help you save more for your retirement.

Prs is a voluntary long term investment scheme designed to help individuals accumulate savings for retirement. Private pension schemes workplace pensions and personal or stakeholder pensions are a way of making sure you have money on top of your state pension. It is a savings and investment program to help malaysians financially prepare for retirement.

As we ve heard time and again your epf savings alone will not be enoughto sustain you in your golden years. Commonly asked questions about the private retirement scheme prs what is prs. Private pension administrator ppa malaysia is the central administrator for private retirement schemes.

Prs seek to enhance choices available for all malaysians whether employed or self employed to voluntarily supplement their retirement savings under a well structured and regulated environment. This is especially useful for those who wish to grow their retirement fund and invest but aren t savvy in the area of investment.

.jpg)